Global Users Preferences for Android Phones, Q4 2022

The Android phone market in 2022 is full of impressive features such as satellite communication, 1-inch mobile-device image sensor, and 200W+ charging speed. All these features that were unimaginable three years ago are now available to users.

We have worked out the user preference ranking list in Q4 of 2022 based on the backstage data of AnTuTu. What kind of mobile phones do AnTuTu users prefer? Let's have a look at the preference list.

The point of the quarterly updated preference list is to understand the current development of Android phones and to use this data as a reference to derive the latest trends in smartphones. While the direction of development is partly determined by the mobile phone suppliers, it is users who ultimately make the choice.

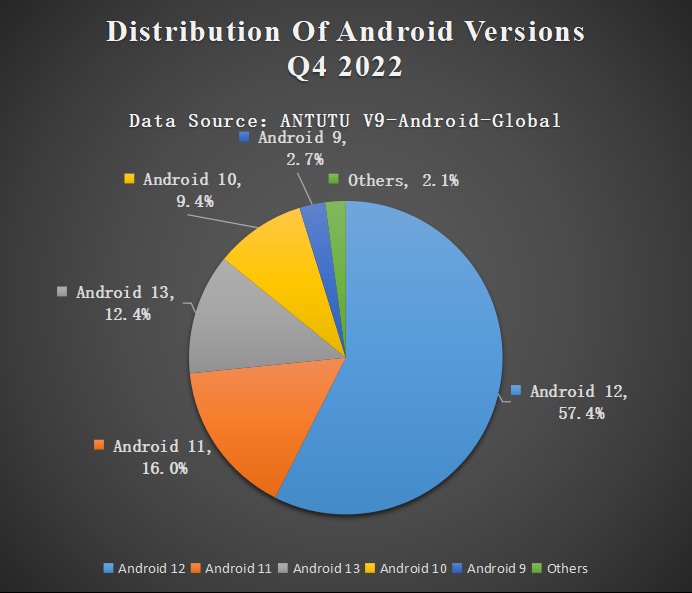

Android Versions

Due to the large number of Android phone manufacturers and the very fast update rate of various phone models, phone manufacturers are not active in updating Android system and most phones can only be updated with the Android version within three years of launch, which affects the user experience of many software on the Android Market.

However, in Q4, as manufacturers gradually started updating Android 13, the share of Android 13 increased a lot, from 1.2% in Q3 to 12.4% in Q4. Correspondingly, the share of older versions of Android all declined. It is strange that the share of Android 9 has not changed, probably because the Android system update for this group of phones is no longer available or has been postponed.

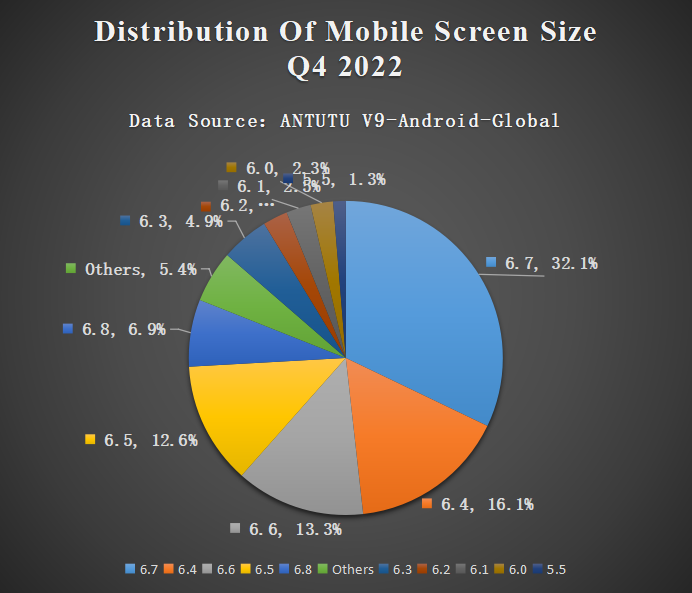

Screen Size

Large mobile phone screens are still the preferred choice in the market today, with the majority of mobile phone screen sizes being 6.4-6.8 inches, with 6.7-inch screen still accounting for the highest percentage at 32.1%.

The share of large screens is still growing modestly compared to Q3, but it is hard to say whether this growth will be sustainable with the emergence of foldable phones.

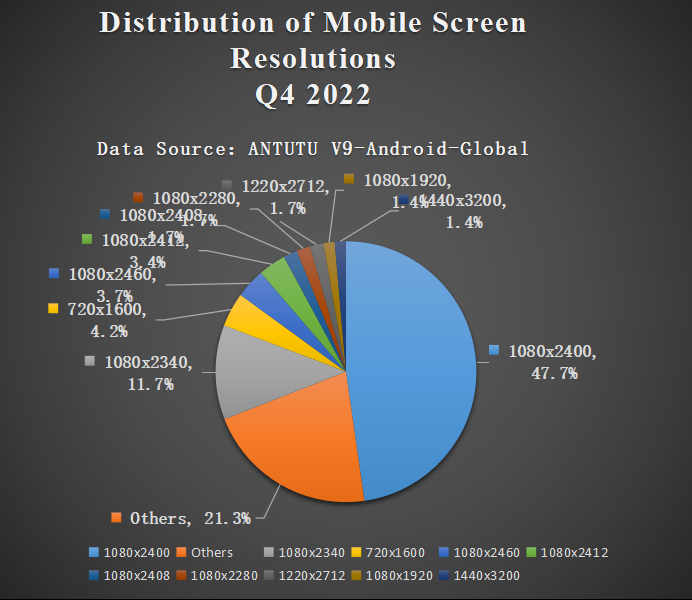

Screen Resolution

The 2K resolution has not yet been popularized, so the highest percentage of smartphone screens used by AnTuTu users is still 1080p resolution, accounting for 47.7%.

The 1.5K resolution launched by Redmi also seems to be accepted by users, with 1.7% share of 1.5K resolution in Q4, already surpassing the share of 2K resolution. And with more 1.5K resolution sub-flagships and mid-range phones expected to hit the market soon, this share is likely to continue to rise in Q1 2023.

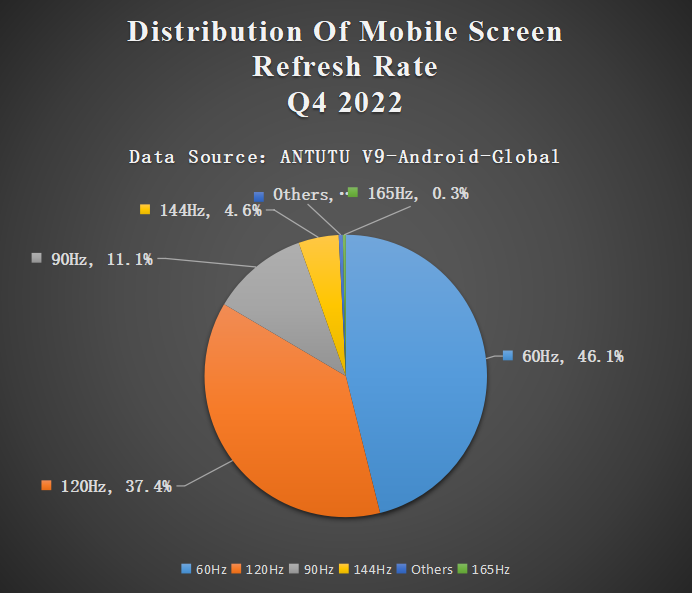

Screen Refresh Rate

In Q4 2022, the 60Hz refresh rate accounted for 46.1% and the 120Hz refresh rate accounted for 37.4%. Phones equipped with high screen refresh rates of 120Hz and above are currently not yet the largest share of the market, but with the popularity of such phones in the mid-range market, the 120Hz refresh rate will certainly gradually become mainstream.

The 144Hz refresh rate accounted for 4.6%, 165Hz refresh rate accounted for 0.3%. The difference in the experience of using a refresh rate higher than 120Hz may not be obvious, but can still be felt. 165Hz refresh rate brings better visual experience and smoother sliding effect. Therefore an upgrade in screen configuration is always a benefit, provided that the power consumption is taken into account.

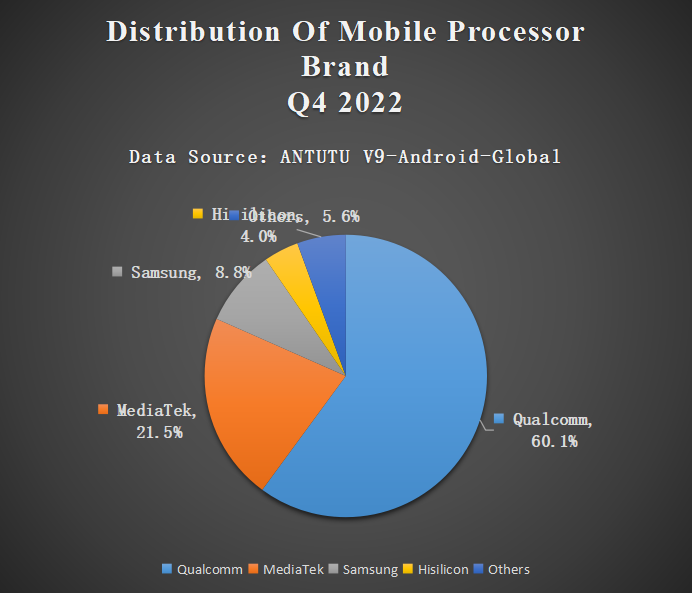

Processor Brand

Qualcomm continued to have the highest market share in the fourth quarter, at 60.1%. MediaTek's share was 21.5%, an increase of 3.3% compared to the third quarter, ranking second. The Snapdragon 8+ processor entered the sub-flagship phone market in the last month of the fourth quarter, after which a wave of cost-effective sub-flagship phones with this processor hit the market.

The increase in MediaTek's market share should be attributed to the Dimensity 8100 processor, which was released before the Snapdragon 8 Gen 2. The Dimensity 9000 and Dimensity 9000+ are not used much in the market. The most popular processor throughout 2022 is the Dimensity 8100, with every brand having a new phone with it on the market.

Hisilicon and Samsung still have a small market share with their older mobile phone models.

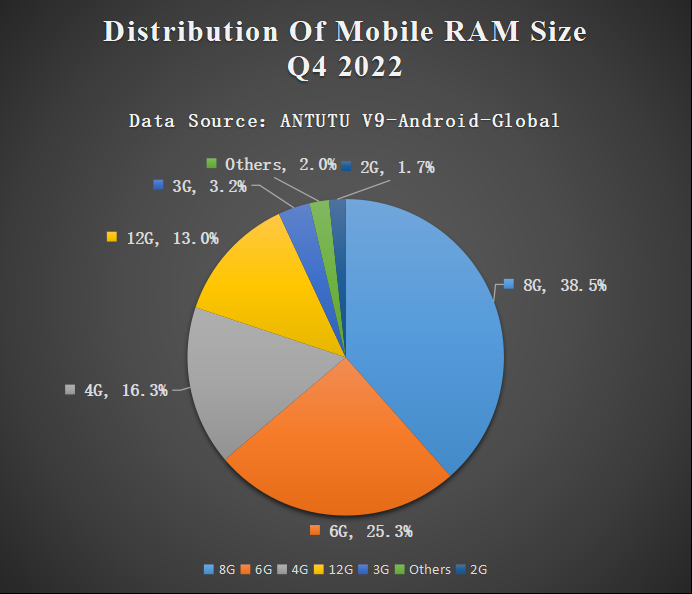

RAM Size

Except for 8GB RAM and 12GB RAM, which have seen a slight increase in market share, the rest of the RAM sizes have shown a downward trend, as expected with the gradual increase in RAM sizes. For example, the just-announced OnePlus 11 starts with 12GB of RAM size directly. There are very few sub-flagship phones with 8GB RAM versions anymore, and only mid-range and low-end phones still have them. 16GB is grouped under the Others category, and this RAM size does not seem to be popular in the international market.

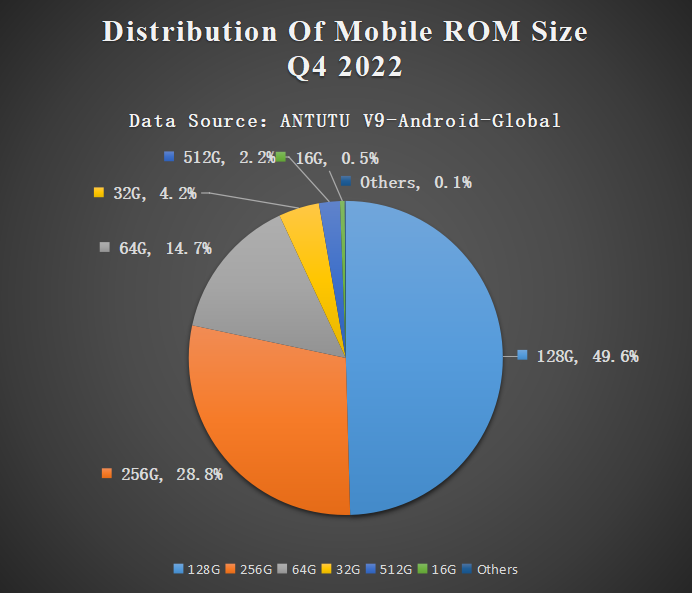

ROM Size

Similar to RAM sizes, all ROM sizes showed a declining market share in Q4, except for 256GB and 512GB.

128GB ROM is still the mainstream in the market, still accounting for 49.6% after a 0.6% drop from the previous quarter. With games and applications taking up more and more memory, the market share of 128GB ROM will continue to show a downward trend. At the same time, the adoption of UFS 4.0 will also expand the market share of 256GB.

That's all for AnTuTu's global users' preferences for Android Phones in Q4 2022. It should be noted again that the ranking list only represents the preferences of AnTuTu users rather than the configuration distribution of the overall Android mobile phone market.

The Chinese New Year is coming soon. Wish you success and prosperity in the year of the rabbit.