Global Users Preferences for Android Phones, Q2 2022

It's already July, and the mobile phone market is set to see a wave of new Android flagships in the second half of 2022. Now is the right time to review the development of Android phones in the first half of the year.

In contrast to the monthly lists, the significance of the quarterly updated preference lists is to understand the current development of Android phones and to use these data as a reference to derive recent trends in smartphones. While the direction of development is partly determined by the mobile phone suppliers, it is users who ultimately make the choice.

We have worked out the user preference ranking list in Q2 of 2022 based on the backstage data of AnTuTu. What kind of mobile phones do AnTuTu users prefer? Let's have a look at the ranking list.

It should be noted that this preferences list is prepared based on the phone configurations of AnTuTu users and thus it does not represent the preferences of the overall Android market.

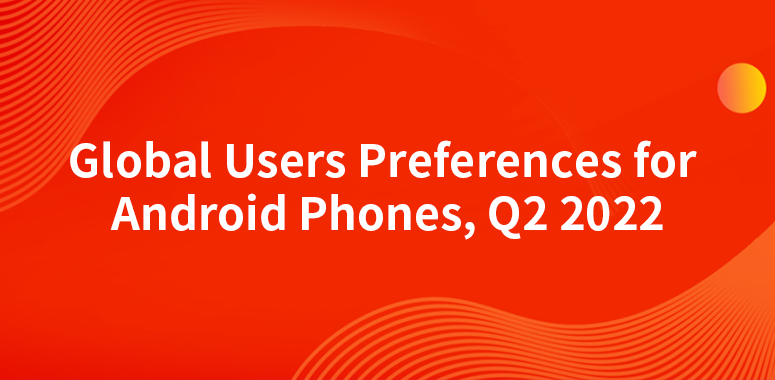

Screen Size

Screen sizes changed little in the second quarter compared to the first quarter. The largest share remained at the 6.7-inch screen with 33.4%, a slight increase of 2.8% compared to the first quarter. This was closely followed by the share of a 6.4-inch screen with 15.4%, a more significant increase compared to 13.2% in Q1. In the first quarter, the 6.4-inch screen was only fourth in the list, with the 6.5-inch screen in second place.

The Chinese mobile phone market is making screens bigger and bigger, while at the same time, the overseas mobile phone market is actually seeing an increase in the 6.4-inch screen share, which is a rare occurrence. It seems that not everyone prefers larger screens, and that smaller screen sizes are still very popular in the overseas market.

Screen Resolution

In terms of screen resolution, 1080p remains the mainstream, with the highest share being 1080 x 2400 and an overall share of 53.2%, slightly lower than 53.5% in Q1.

A little higher resolution than 1080p is 1440p, and it is logical that with the direction of higher and higher resolutions, 1440p should account for more and more, but in the second quarter, the share of 1440p resolution phones declined compared to the first quarter, from 2.3% to 1.6%. It seems that overseas Android phone users not only prefer smaller screens but are also not too concerned about the increased resolution of the screens.

The advantage of a lower resolution, however, is that the power consumption of mobile phones will be reduced.

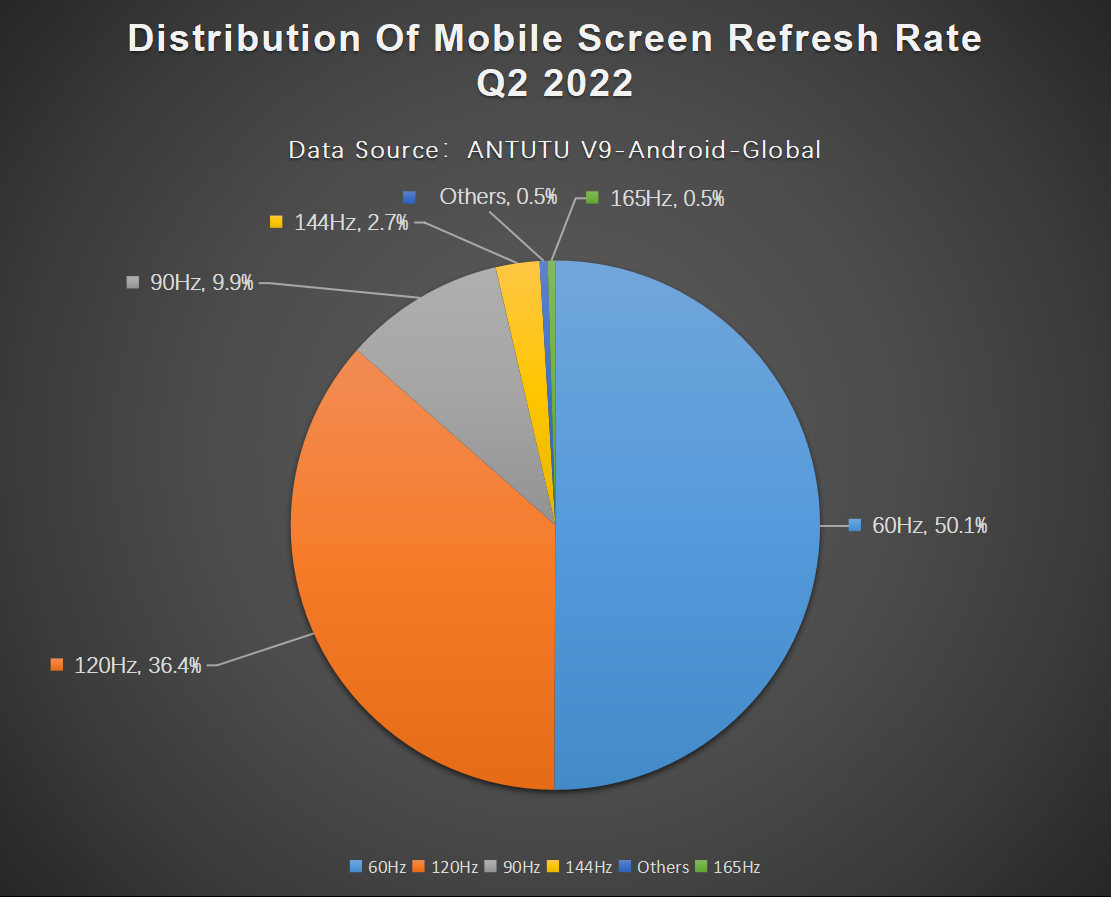

Processor Brand

Compared to the first quarter of this year, Qualcomm's market share increased by 1.2%, MediaTek's by 1.1%, and both Samsung Exynos and Hisilicon' shares decreased. It is now mainly MediaTek and Qualcomm that are competing for processor market share. MediaTek has been on the rise even though each increase has been small.

Other processor brands: Samsung Exynos, HiSilicon, and others. The combined share of these three categories is not as high as that of MediaTek.

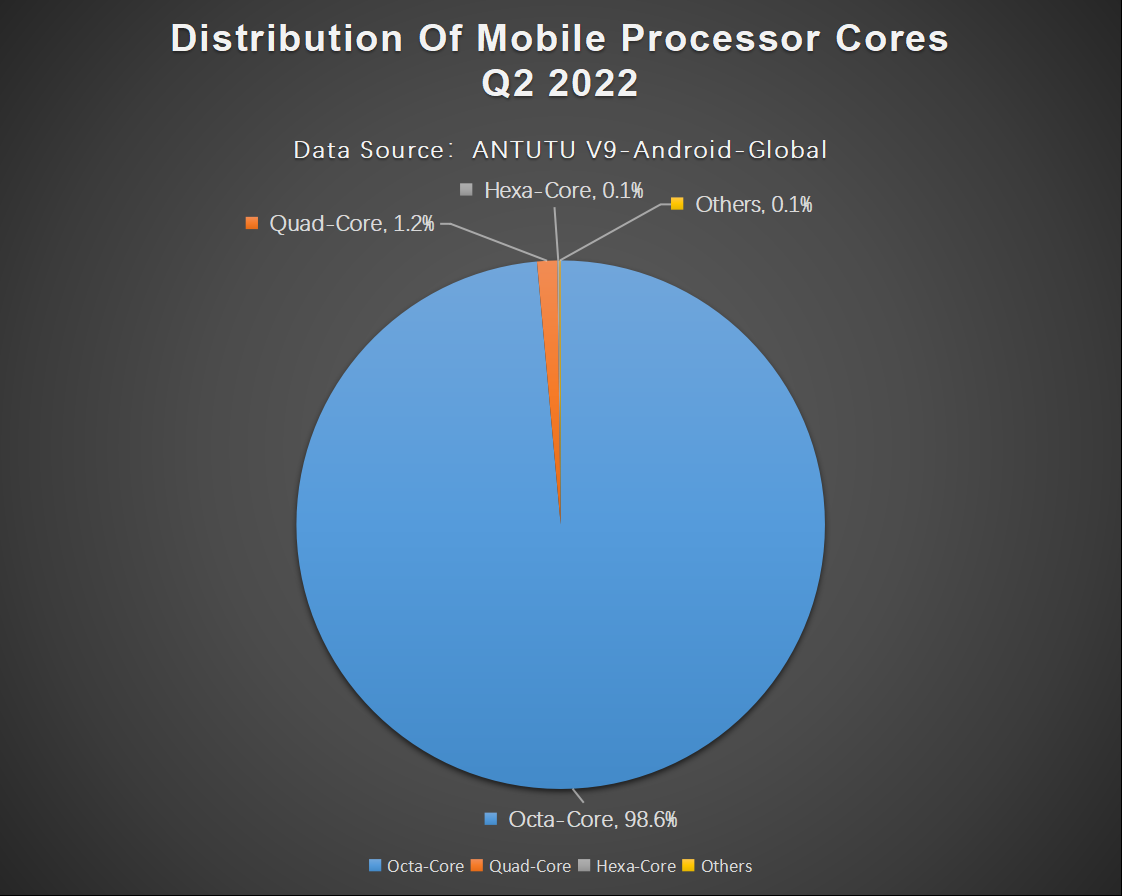

Processor Cores

The market share of Octa-core phones increased by 0.1% compared to the first quarter, reaching 98.6%, and reaching 100% is just a matter of time.

The pie chart includes Qualcomm, Mediatek, HiSilicon, and other brands. As for why Quad-core and others still occupy a small share of the pie chart, it's just that some of the old users are still using them, perhaps as a backup or a nostalgic product, pretty much the same as last quarter.

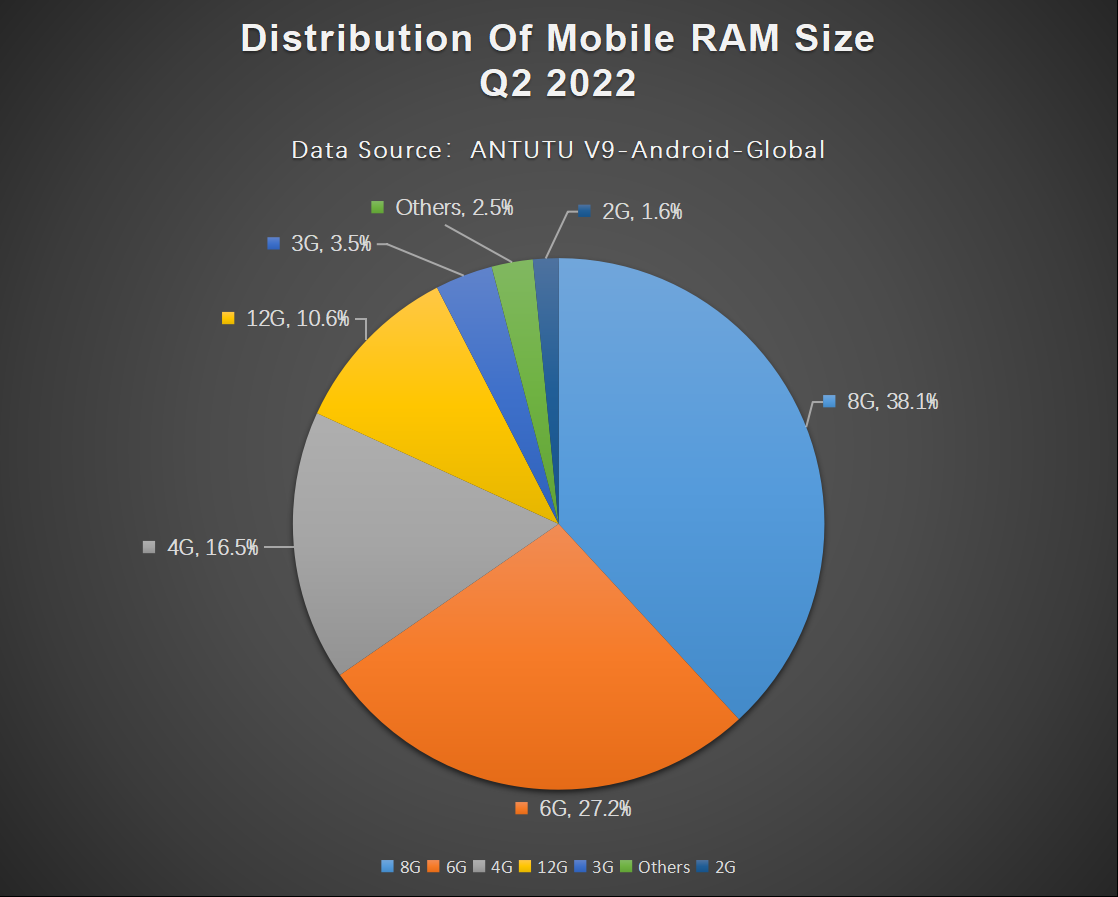

RAM Size

In terms of RAM size, 6G RAM is still in first place at 27.2%, but its share has been falling for three consecutive quarters. In contrast, the share of 12G RAM is on a clear upward trend, ranking fourth with 10.6% in this quarter.

Somewhat surprisingly, the share of 4GB RAM also increased by 1.1% in this quarter to 16.5%. It could be that some countries released new entry-level models of certain brands.

Many brands in the Chinese mobile phone market have now removed the starting 6GB version, in contrast to the less competitive overseas Android phone market.

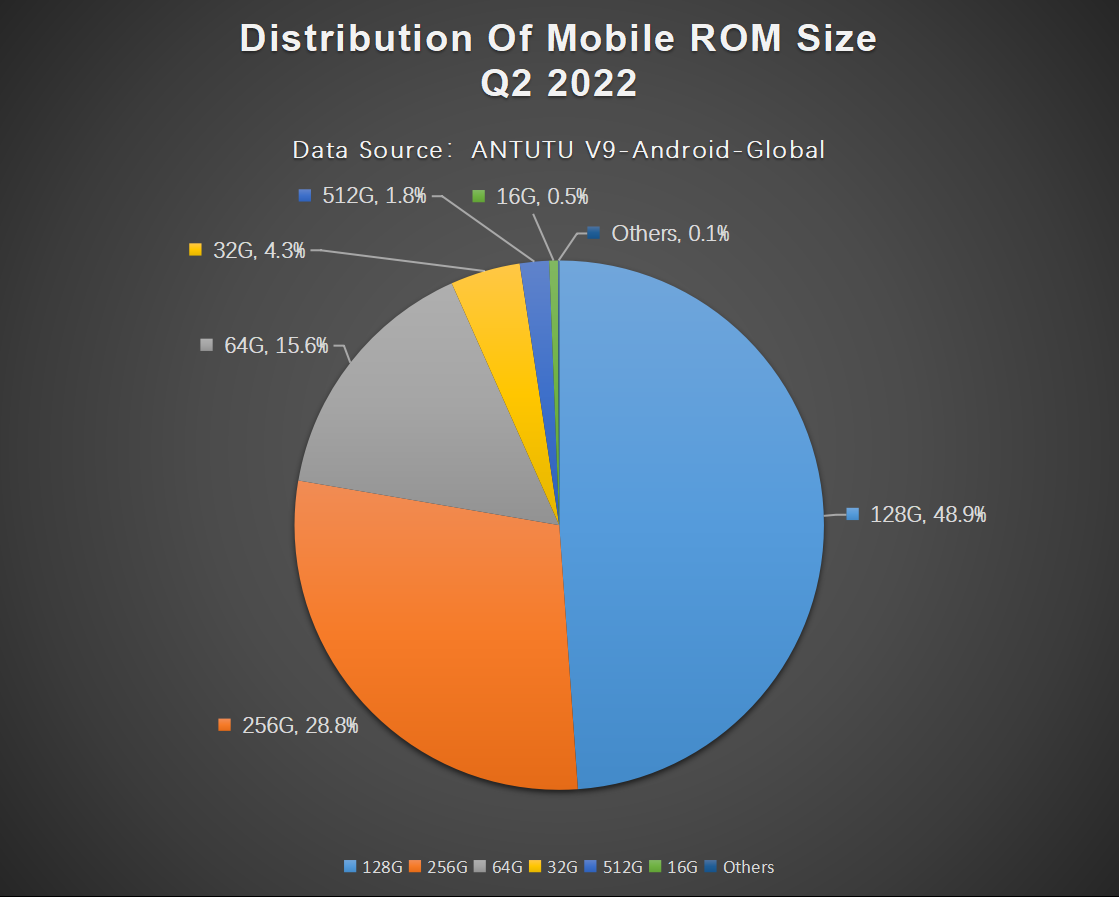

ROM Size

In terms of ROM size, the share of 64GB and 128GB decreased by 0.4% and 0.9% respectively compared to the first quarter, while 256GB increased by 1%. This is broadly similar to the situation in the Chinese mobile phone market, only with relatively smaller changes.

The easiest and fastest-growing part of the mobile phone industry is the size of RAM and ROM. Mobile apps now always start with hundreds of megabytes, and games require more than 10GB of space, if the ROM size is not enough, the phone will not run smoothly.

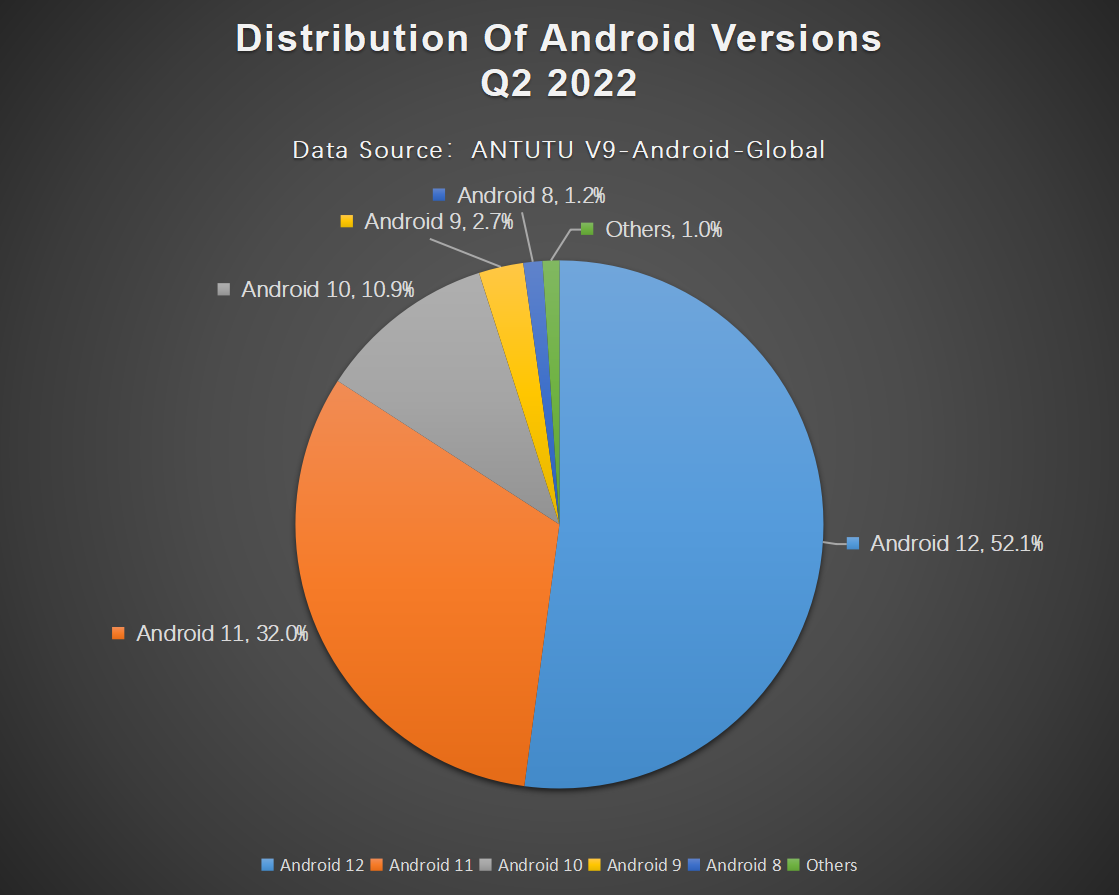

Android Versions

For Android phone users nowadays, the version of Android is not so important, what attracts users more is the distinctive UI of each major mobile phone manufacturer.

The pie chart shows that Android 12 has quickly become mainstream after its release, with a share of 52.1%, an increase of 25.8% compared to the first quarter. The use of the latest Android version is a direction of competition in the current mobile phone market, which shows responsibility to users as well as the strength of manufacturers in terms of software systems.

In contrast, the share of Android 11 has dropped by 24%, largely replaced by the newer version.

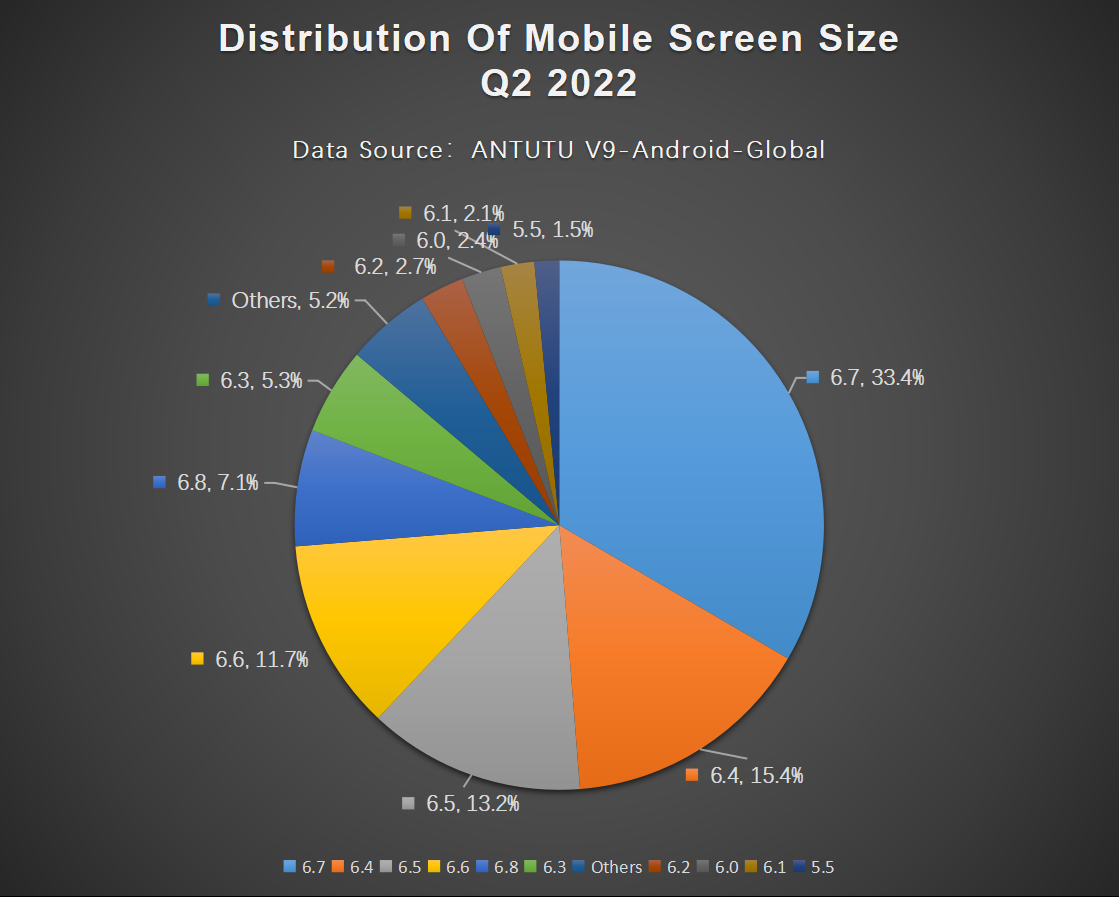

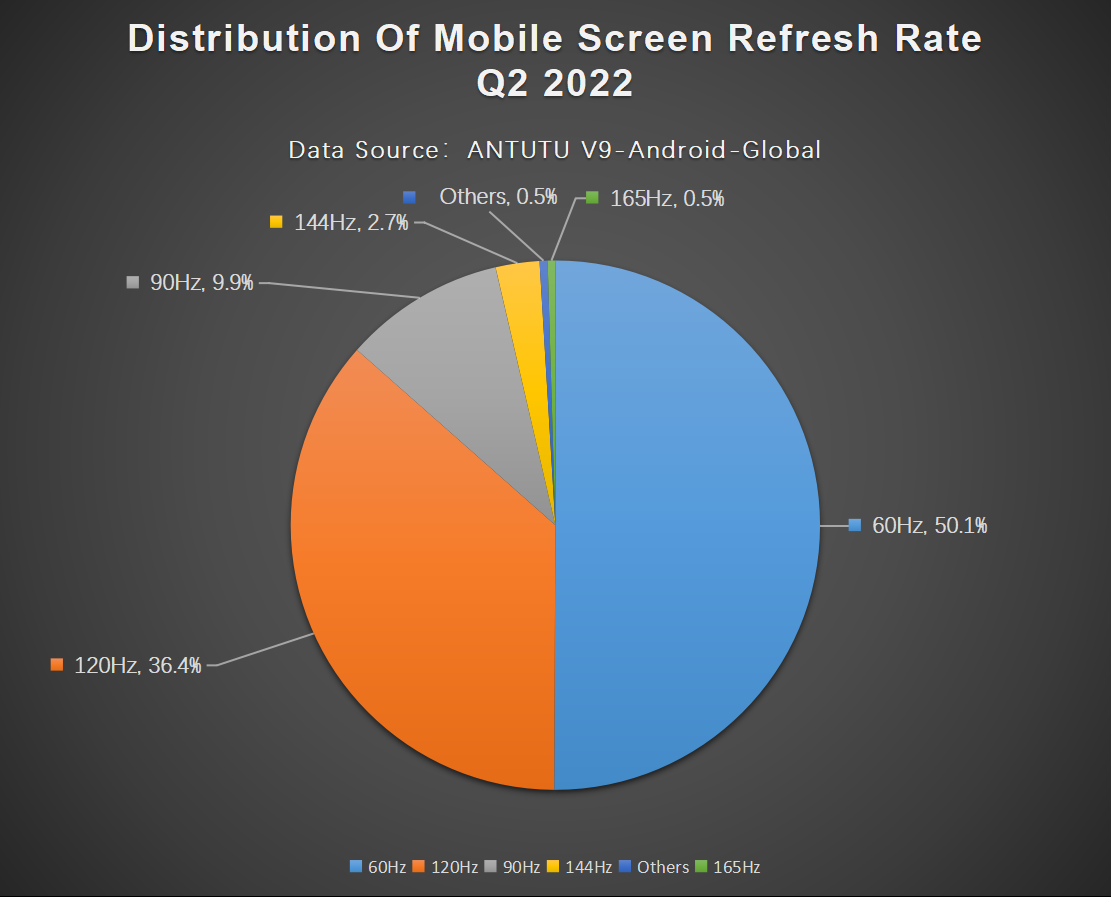

Screen Refresh Rate

High refresh rate is another mobile phone manufacturer's competition object after 2K high-resolution screen, it brings a more noticeable change in the actual perception of the human eye than the high-resolution screen. If a user uses a screen with a 120Hz refresh rate for a week, he will definitely feel the screen getting noticeably laggier when using 60Hz.

We can see that the 60Hz refresh rate still accounts for the largest share of the pie chart, this is because a large number of flagship phones have been upgraded to the latest LTPO 2.0, with more accurate adaptive refresh rate adjustment and a more power-efficient screen. 120Hz is actually the real mainstream of the market.

The share of 60Hz refresh rate is 50.1% and 120Hz is 36.4%. The share of 144Hz and 165Hz ultra-high refresh rate phones also increased by 0.1% and 0.2% respectively, which are supposed to be gaming phones.

Compared with the Chinese mobile phone market, the competition in the overseas market is not so intense. Therefore, the development of mobile phones in the future should be first seen from the brands in the Chinese mobile phone market.

That's all for AnTuTu's global users' preferences for Android Phones in Q2 2022. It should be noted again that the ranking list only represents the preferences of AnTuTu users rather than the configuration distribution of the overall Android mobile phone market.